Choosing the Right Payroll Outsourcing Services for Your Accounting Firm

Discover how to choose the best payroll outsourcing services in Australia for your accounting firm. Save time, reduce risk, and scale with expert payroll providers.

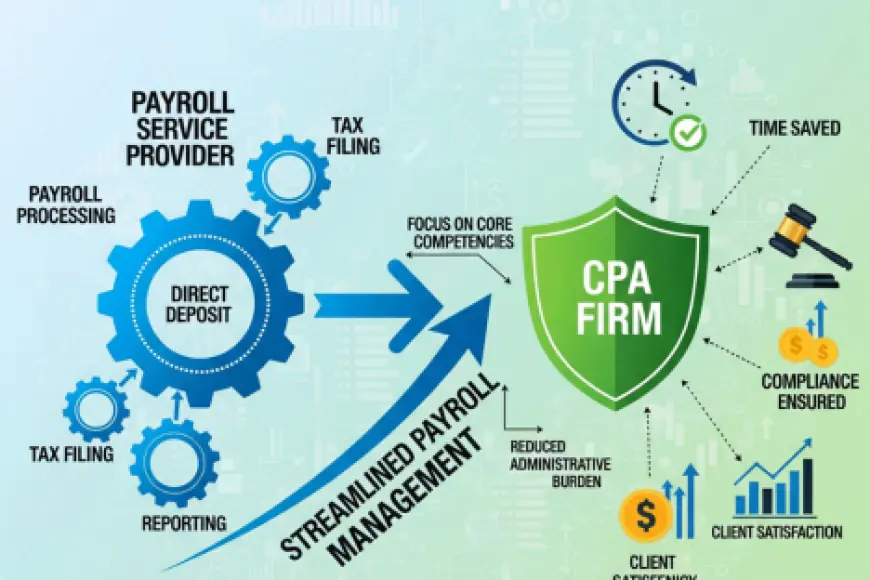

For accounting firms in Australia, the demand for efficient, compliant, and scalable payroll solutions continues to grow. Whether you're serving multiple small businesses or managing enterprise-level clients, handling payroll internally can be time-consuming and complex. This is why many firms are turning to payroll outsourcing as a strategic way to reduce workload and deliver better client value.

But with so many payroll providers in the market, how do you choose the right one?

In this blog, we’ll guide you through key factors to consider when selecting outsourced payroll services for your accounting practice—ensuring you find a provider that meets your needs, supports growth, and stays aligned with Australian payroll regulations.

Why Accounting Firms Are Outsourcing Payroll

Outsourcing payroll offers significant benefits to accounting firms:

-

Reduces administrative burden

-

Ensures ATO and Fair Work compliance

-

Provides access to specialist payroll expertise

-

Saves costs on software and internal staff

-

Scales easily with your client base

Instead of spending hours every month managing timesheets, award rates, superannuation, and STP reporting, firms can rely on dedicated experts to handle payroll accurately and efficiently.

What to Look for in a Payroll Outsourcing Partner

When evaluating potential payroll outsourcing providers in Australia, consider these essential factors:

✅ 1. Experience with Australian Payroll Compliance

Australia’s payroll landscape is complex. It involves:

-

Fair Work rules and industry awards

-

Superannuation contributions

-

Single Touch Payroll (STP Phase 2)

-

Leave entitlements and penalty rates

-

Tax file number declarations and PAYG withholding

Look for payroll providers who specialise in the Australian market. They should demonstrate clear knowledge of current laws and a strong track record in ATO compliance.

✅ 2. Ability to Scale with Your Firm

As your accounting practice grows, your payroll partner should scale with you—whether that means handling more clients, processing more pay cycles, or offering white-labelled services.

Choose a provider that offers:

-

Custom packages for growing firms

-

Flexibility in pay frequency and employee numbers

-

Options for white-label or co-branded payroll solutions

-

Multi-client dashboard or portal access

Scalability is key to sustainable growth, especially if you’re serving clients across various industries and states.

✅ 3. Integration with Accounting Software

The best payroll outsourcing services seamlessly integrate with platforms your firm already uses, such as:

-

Xero

-

MYOB

-

QuickBooks

-

Reckon

This integration minimises double entry, streamlines reporting, and ensures payroll data flows smoothly between systems.

✅ 4. Transparent Pricing

Avoid providers that offer vague or overly complex pricing models. The right partner will have clear, flexible plans—whether it’s per pay run, per employee, or based on service tiers.

Ask about:

-

Setup or onboarding fees

-

Charges for STP submissions

-

End-of-year processing costs

-

Support or troubleshooting costs

Transparent pricing helps you quote payroll services confidently to your clients.

✅ 5. Data Security and Confidentiality

Payroll data includes sensitive information: bank details, tax file numbers, addresses, and income. Your provider must uphold the highest standards in data security, including:

-

ISO/IEC 27001 certification

-

Secure data encryption

-

Two-factor authentication

-

Australian data residency (preferably)

Confirm where their servers are hosted and how they manage access controls, backups, and breach responses.

✅ 6. Customer Support and Local Availability

Responsive customer service is vital—especially during payroll deadlines or EOFY processing.

Choose a provider offering:

-

Local or Australia-aligned support hours

-

A dedicated account manager

-

Fast turnaround on support requests

-

Regular service level reporting (SLAs)

Reliable support builds trust and helps you deliver consistent service to your clients.

Types of Payroll Outsourcing Services Available

Depending on your firm’s needs, you may opt for different levels of payroll outsourcing, such as:

| Service Level | Description |

|---|---|

| Full-service Payroll | End-to-end payroll processing including tax and STP |

| Managed Payroll Support | Shared responsibilities with in-house teams |

| White-labelled Payroll | Provider operates under your firm’s branding |

| Compliance-only Services | Focus on award interpretation, tax filing, and STP |

Customisation is key. Make sure the provider can tailor solutions to meet your internal processes and client expectations.

Questions to Ask Before Committing

Before partnering with a payroll outsourcing provider, ask:

-

How many accounting firms do you currently serve?

-

What industries do you specialise in?

-

How do you handle updates to legislation or award rates?

-

Can you provide case studies or testimonials?

-

What systems do you integrate with?

-

Is your team based in Australia or offshore?

These questions help you assess the provider’s experience, reliability, and alignment with your business.

Common Mistakes to Avoid

-

Choosing based on cost alone

Cheap services often lack flexibility, support, or compliance expertise. -

Ignoring compliance updates

Ensure the provider takes full responsibility for ongoing changes in legislation. -

Failing to define roles and responsibilities

Be clear on what tasks they handle and what remains with your team. -

Overlooking scalability

Always think long-term. Choose a provider that grows with your practice.

Final Thoughts

Choosing the right payroll outsourcing partner is a strategic decision that can greatly impact your accounting firm’s efficiency, reputation, and growth. By delegating time-consuming payroll tasks to trusted payroll providers, you gain more time to focus on client relationships and high-value advisory services.

In Australia’s highly regulated payroll environment, the value of expert support can’t be overstated. Look for a partner who understands your firm, your clients, and the local compliance landscape—and you'll be set for long-term success.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0