China Health Insurance Market Size, Share, Growth, Trends and Forecast 2025-2033

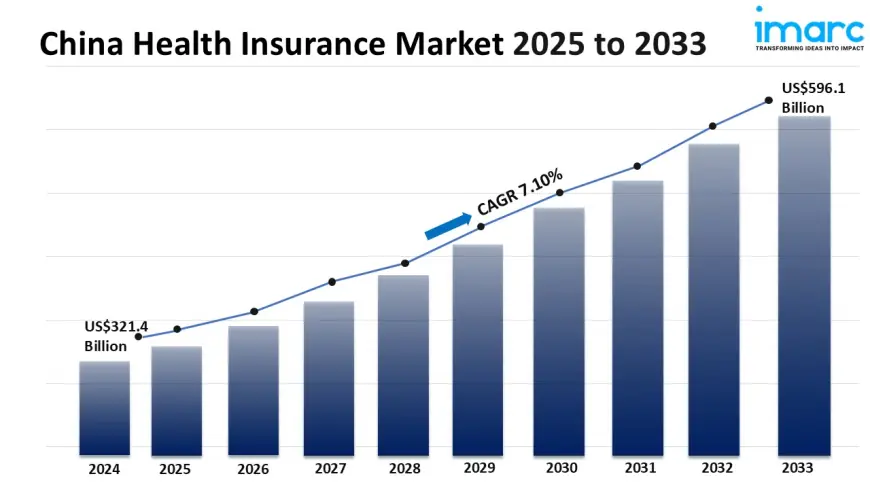

The China health insurance market size reached USD 321.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 596.1 Billion by 2033, exhibiting a growth rate (CAGR) of 7.10% during 2025-2033.

China Health Insurance Market Overview

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 321.4 Billion

Market Forecast in 2033:USD 596.1 Billion

Market Growth Rate (2025-33): 7.10%

The China health insurance market size reached USD 321.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 596.1 Billion by 2033, exhibiting a growth rate (CAGR) of 7.10% during 2025-2033. The market is primarily driven by the increasing number of chronic ailments, the widespread adoption of supportive government policies, the growing geriatric population, and the rising demand for higher-quality medical services in China.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/china-health-insurance-market/requestsample

China Health Insurance Market Trends and Drivers:

The Chinese health insurance market is booming, thanks to a wave of digital integration and the rise of interconnected health ecosystems. Insurers are quickly tapping into big data analytics, AI-driven underwriting, and user-friendly digital platforms like mobile apps and WeChat mini-programs to make customer acquisition, claims processing, and risk assessment smoother than ever. This digital transformation boosts operational efficiency, allowing for quicker policy issuance and settlements, which greatly enhances the customer experience. At the same time, strategic partnerships are creating vast ecosystems—insurers are teaming up with hospitals, pharmacies, telemedicine providers (like Ping An Good Doctor), fitness trackers, and chronic disease management platforms. This collaboration goes beyond just reimbursement; it’s about proactive health management, offering policyholders valuable services such as online consultations, medication delivery, health monitoring, and personalized wellness incentives. The massive amount of data generated enables hyper-personalized products, like usage-based insurance (UBI) linked to healthy behaviors or dynamic pricing models. This digital-first, ecosystem-driven approach is not only appealing to tech-savvy individuals but is also broadening the insurable population through innovative, accessible micro-insurance products available via super-apps, leading to premium growth projected to maintain double-digit annual increases.

The evolving regulatory landscape under the China Banking and Insurance Regulatory Commission (CBIRC) is actively shaping the future of the market, driving both innovation and accessibility. Some key initiatives include promoting exclusive commercial health insurance products in pilot cities, which integrate with basic social medical insurance, offering tax incentives for private health coverage, and implementing stricter governance to ensure product transparency and solvency. This supportive environment is empowering insurers to create innovative solutions that address significant gaps in coverage. There’s a growing demand for comprehensive plans that go beyond basic social security, especially for critical illnesses, high-cost specialty drugs like cutting-edge cancer therapies, advanced diagnostics, and access to premium hospitals. Insurers are stepping up with a variety of offerings, such as long-term care insurance riders linked to life policies, supplemental coverage for managing expensive chronic diseases like diabetes and hypertension, and specialized plans for high-deductible health plans (HDHPs) that work alongside Health Savings Accounts (HSAs). Additionally, parametric insurance products, which pay out fixed amounts upon specific disease diagnoses, are becoming popular due to their straightforward nature. This blend of favorable regulations and targeted product innovation is significantly broadening the market, catering to the increasing demand for financial protection against rising healthcare costs and specialized needs, particularly as the population ages and health awareness grows.

The combination of significant demographic changes, rising healthcare costs, and shifting consumer expectations is driving a strong long-term demand for health insurance in China. With over 290 million people aged 60 and older today, and projections suggesting this number will surpass 400 million by 2035, there’s an urgent need for financial solutions that address age-related chronic conditions, long-term care, and geriatric services—areas where public coverage is still quite limited. At the same time, healthcare expenses are growing faster than income, fueled by cutting-edge medical technologies, soaring drug prices, and a greater reliance on premium private healthcare facilities, which puts a heavy financial burden on individuals. Today’s consumers are becoming more affluent and health-savvy, and with easy access to information online, they want more than just financial reimbursement. They’re looking for comprehensive solutions that include preventive care, wellness programs, easy access to quality providers (like Tier 3 hospitals and international facilities), quicker claims processing, and personalized customer service. This shift is pushing insurers to move away from traditional indemnity models and become integrated health management partners, providing value-based care coordination, second medical opinions, and thorough health navigation services. The vast unmet needs, especially in critical illness coverage, outpatient benefits, and specialized care for the elderly, create a huge and expanding market for advanced private health insurance solutions.

China Health Insurance Market Industry Segmentation:

Provider Insights:

- Private Providers

- Public Providers

Type Insights:

- Life-Time Coverage

- Term Insurance

Plan Type Insights:

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

Demographics Insights:

- Minor

- Adults

- Senior Citizen

Provider Type Insights:

- Preferred Provider Organizations (PPOs)

- Point of Service (POS)

- Health Maintenance Organizations (HMOs)

- Exclusive Provider Organizations (EPOs)

Regional Insights:

- North China

- East China

- South Central China

- Southwest China

- Northwest China

- Northeast China

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=23434&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0