Automotive NVH Materials Market 2030 Industry Overview

The automotive NVH materials market is driven by stringent noise regulations, consumer demand for quieter vehicles, and advancements in material science and engineering.

Introduction

The Global Automotive NVH Materials Market is spotlighting a new era of automotive sophistication. From luxury sedans to commercial heavy‑duty vehicles, brands are evolving to deliver quieter, smoother journeys. Valued at USD 12.68 billion in 2024, the market is projected to soar to USD 18.17 billion by 2030, expanding at a CAGR of 6.19%. As automakers pivot toward electric mobility and heightened comfort standards, demand for advanced NVH materials—ranging from acoustic foams to damping composites—is accelerating.

Industry Key Highlights

- Market worth USD 12.68 billion in 2024, growing to USD 18.17 billion by 2030 at 6.19% CAGR.

- Passenger cars dominate consumption, with rising uptake in commercial vehicles.

- Material types such as rubber, plastics & foams, and fibrous composites drive product innovation.

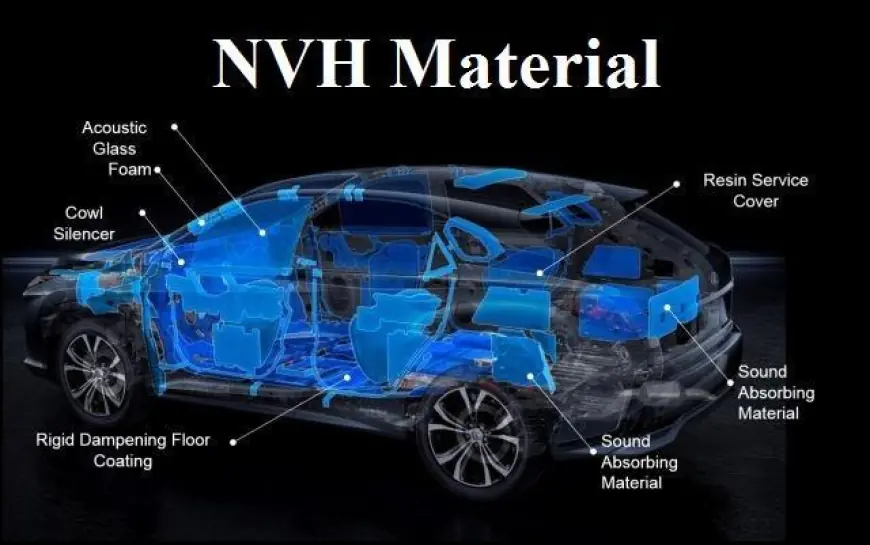

- Applications include sound absorption, vibration damping, and insulation.

- The Asia‑Pacific region leads growth, fueled by rapid vehicle production and EV adoption.

Download Free Sample Report: https://www.techsciresearch.com/sample-report.aspx?cid=19291

Market Drivers

1. Rising Consumer Expectations

Automotive buyers now expect serene, vibration‑free interiors. Quiet cabins are a symbol of refinement, prompting OEMs to incorporate premium NVH materials throughout chassis, doors, and engine bays.

2. Electric Vehicle (EV) Transition

With EVs minimizing engine noise, motor hum, road noise, and wind turbulence emerge more plainly. Manufacturers rely on NVH solutions tailored to EV dynamics—such as acoustic liners and adaptive dampers—to maintain cabin tranquility.

3. Stringent Regulations on Noise Emissions

Global regulatory bodies are enforcing stricter standards for permissible vehicle noise. Manufacturers eye materials that not only meet norms but also confer competitive comfort advantages.

4. Lightweighting & Sustainability

Automakers are under mounting pressure to reduce vehicle weight without compromising NVH performance. Emerging eco‑friendly and lightweight NVH materials—like bio‑based foams and fiber composites—are taking center stage.

5. Technological Innovation in Materials Science

Nanotechnology, hybrid composites, and smart NVH films are enabling next‑generation products offering superior damping with reduced thickness and cost.

Emerging Trends in Automotive NVH Materials

Smart NVH Materials & Adaptive Performance

Materials embedded with sensors or phase‑change properties that adapt according to road or drivetrain vibrations are gaining traction. These systems dynamically respond to changing noise profiles, optimizing comfort and energy efficiency.

Eco‑Friendly & Bio‑Derived Acoustic Products

Brands are adopting materials formulated from recycled polymers, natural fibers, and low‑VOC foams. These align with auto industry sustainability goals and reduce VOC emissions inside vehicle cabins.

3D‑Printed & Additively Manufactured Parts

Rapid prototyping and production of complex damping structures are now possible via additive manufacturing. These techniques enable lightweight designs with tailored acoustic performance.

Integration with Telematics and Infotainment

Advanced NVH materials are being co‑engineered with sound systems and active noise control features to provide immersive acoustic experiences—especially in premium EV and hybrid models.

Segmentation Overview

By Vehicle Type

- Passenger Cars lead market share—consumers demand refined acoustics.

- Commercial Vehicles (trucks, buses, vans) benefit from NVH elements to reduce driver fatigue and meet noise compliance in harsh operational conditions.

By Material Type

- Rubber: Durable and versatile for insulation pads and seals.

- Plastic & Foam: Broad use in liners and headliners for sound absorption.

- Fibers: Lightweight and flame‑resistant materials used in bulkheads and interiors.

By Application

- Absorption: Porous liners for reducing airborne noise.

- Damping: Viscoelastic materials addressing mechanical vibrations.

- Insulation: Barrier layers that block noise transfer.

By Region

- Asia‑Pacific: Growth driven by vehicle production (China, India, Japan), expanding EV adoption, and rising investments in material R&D.

- North America & Europe: Demand persists in premium and commercial segments; regulatory pressure sustains growth.

Competitive Analysis

Major Players: BASF SE, 3M, Dow Chemical, Covestro AG, Sumitomo Riko, ElringKlinger, KKT Holding.

Strategic Moves

- Product Innovations: Light‑weight foams, next‑gen dampers, bio‑derived composites.

- Partnerships with OEMs: Co‑development of material solutions tailored to specific vehicle lines, especially EV platforms.

- Mergers & Acquisitions: Consolidating niche acoustic specialists to scale R&D and broaden geographic reach.

Future Outlook

The road ahead for the Global Automotive NVH Materials Market is promising:

- As EV adoption accelerates, noise profiles change, elevating NVH importance. OEMs increasingly integrate acoustic design early in vehicle platforms.

- Regulations on noise pollution are tightening in urban zones globally, requiring more robust acoustic dampening.

- The high-performance segment in luxury, autonomous, and shared mobility—where comfort, quietness, and vehicle refinement are paramount—is expanding.

- Lightweight composites, bio‑based materials, and smart adaptive systems are expected to dominate R&D spending.

By 2030, NVH materials will shift from cost centers to value‑adding differentiators, critical to branding, user experience, and sustainability narratives.

10 Benefits of the Research Report

- Forecast market size and CAGR outlook from 2024 through 2030.

- Segment‑wise breakdown for vehicle type, material type, application, and region.

- Identification of emerging NVH trends and material innovations.

- Insight into regulatory drivers and sustainability impact.

- Competitive benchmarking of key players’ R&D and partnerships.

- Market dynamics analysis: supply, demand, pricing.

- Scenario planning for EV transition and lightweighting needs.

- Regional adoption mapping—growth forecasts by Asia‑Pacific, North America, etc.

- Guidance for new entrants, suppliers, and component partnerships.

- Strategy recommendations for OEMs adopting next‑gen NVH materials.

Competitive Analysis (Detailed)

BASF SE

- Offers comprehensive acoustic materials (e.g., foam insulators, damping sheets).

- Strong global OEM relationships and sustainability programs reduce carbon footprint.

3M Company

- 3M’s acoustic foils and adhesive liners are highly customizable.

- Extensive R&D investments provide competitive edge in smart NVH solutions.

Dow Chemical Company

- Specializes in polymer-based acoustic composites known for cost-efficiency.

- Offers integration into lightweight vehicle architecture programs.

Covestro AG

- Pioneer in polycarbonate foams and modular interior acoustic systems.

- Focuses on developing green material alternatives.

Sumitomo Riko & ElringKlinger AG

- Regional strength in Japanese and German automotive hubs.

- Known for high-durability rubber composites and noise barrier systems.

Emerging Trends & Drivers (Expanded)

Adaptive Noise Control Integration

Automakers increasingly pair NVH materials with active noise control (ANC) systems. In EVs, ANC combined with targeted acoustic liners can effectively neutralize remaining mechanical and road noise.

Predictive Material Lifecycle Optimization

Materials that degrade predictably help optimize vehicle maintenance schedules. Smart NVH materials may report wear and performance via embedded sensors—useful for fleet operators and autonomous vehicle maintenance.

Multi‑Functional Structural Panels

New composite panels may combine NVH insulation, crash absorption, and thermal shielding—reducing part count and weight while enhancing safety and acoustic performance.

Regulatory Landscape Evolution

Cities globally are implementing low‑noise zones; vehicles with higher NVH performance may be exempt from certain restrictions or benefit from incentives. Governments are also funding pilot OK studies for NVH measurement standards.

Narrative Flow: From Present to 2030

- Current State: Quiet cabins are luxury standard; EVs introduce new acoustic challenges.

- Emerging Materials: Lightweight polymers, VOC‑free foams, fiber composites, and smart films.

- OEM Strategies: Co‑engineering NVH into platforms early, especially EV platforms.

- Global Impact: Asia‑Pacific’s manufacturing scale, Europe/NA’s premium demand, regulatory impetus.

- Beyond 2030: Autonomous mobility, shared fleet acoustics, and smart interior experiences will intensify NVH innovation.

Conclusion

The Global Automotive NVH Materials Market, valued at USD 12.68 billion in 2024 and projected to reach USD 18.17 billion by 2030, stands at the intersection of technology, comfort, and sustainability. As electric vehicles become mainstream and consumer expectations for automotive refinement rise, NVH materials evolve from functional necessity to essential differentiator.

Through innovation in smart materials, eco‑friendly formulations, and adaptive acoustic systems, suppliers and OEMs alike have opportunities to shape quieter, safer, greener mobility experiences. Brands that invest in co‑development, lightweighting, and material multimodal use (absorption, damping, insulation) position themselves for success.

Contact Us-

Mr. Ken Mathews

708 Third Avenue,

Manhattan, NY,

New York – 10017

Tel: +1-646-360-1656

Email: [email protected]

Website: www.techsciresearch.com

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0