United States Reinsurance Market Trends, Growth & Future Outlook 2033

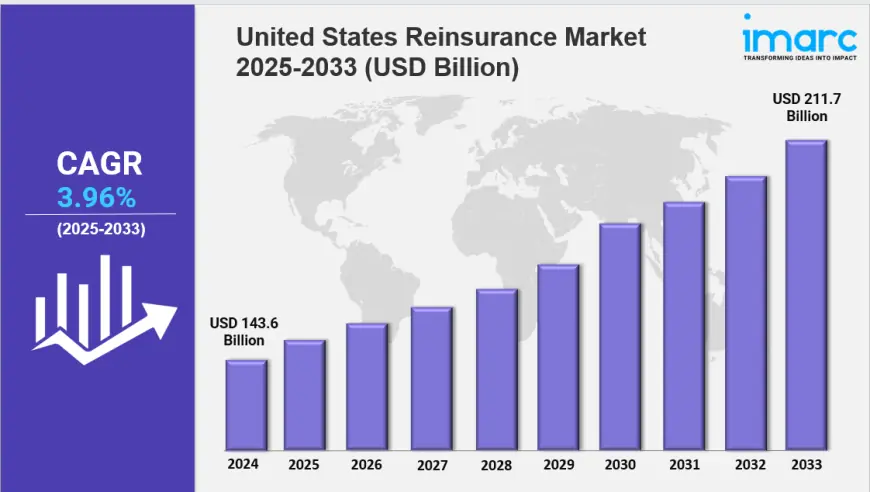

United States reinsurance market size reached USD 143.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 211.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.96% during 2025-2033.

IMARC Group has recently released a new research study titled “United States Reinsurance Market Report by Type (Facultative Reinsurance, Treaty Reinsurance), Mode (Online, Offline), Distribution Channel (Direct Writing, Broker), Application (Property and Casualty Reinsurance, Life and Health Reinsurance), and Region 2025-2033,” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

United States Reinsurance Market Overview

United States reinsurance market size reached USD 143.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 211.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.96% during 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 143.6 Billion

Market Forecast in 2033: USD 211.7 Billion

Market Growth Rate 2025-2033: 3.96%

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-reinsurance-market/requestsample

Key Market Highlights:

✔️ Market growth driven by rising frequency of natural disasters and climate-related risks

✔️ Increasing demand for financial protection and capital relief among insurers

✔️ Expanding adoption of advanced analytics and alternative risk transfer solutions

United States Reinsurance Market Trends

As businesses become more digital, the threat of cyberattacks continues to rise. Data breaches, ransomware, and other online risks have fueled demand for cyber insurance, creating new opportunities for reinsurers. To support primary insurers, many are designing specialized products that address these evolving threats.

This shift is not only about managing higher claim volumes but also about meeting regulatory expectations and helping companies show resilience against cyber risks. By investing in advanced analytics and risk assessment tools, reinsurers are better positioned to price coverage accurately and respond to these complex challenges.

Climate Change Reshaping Risk Models

The impact of climate change is another force transforming the market. Severe weather events such as hurricanes, floods, and wildfires are becoming more frequent, driving insurers to reassess exposure and coverage strategies. Reinsurers play a crucial role here, stepping in to provide additional capacity and expertise.

Alongside traditional catastrophe modeling, there is now a stronger emphasis on sustainability, with insurers and reinsurers collaborating on climate adaptation measures. The integration of environmental, social, and governance (ESG) factors into underwriting is increasingly common, underscoring the market’s focus on long-term resilience. This evolution is a central aspect of United States Reinsurance Market Growth over the coming years.

Regulation and Compliance Pressures

The regulatory environment in the U.S. is also undergoing major changes. New capital requirements, stress testing frameworks, and stricter reporting standards are being introduced to safeguard solvency and transparency. Reinsurers are adapting by strengthening their balance sheets and improving risk management processes.

At the same time, the rapid rise of insurtech has attracted regulatory scrutiny, especially around how technology is applied in underwriting and claims processing. Companies that stay proactive with compliance while embracing innovation are most likely to remain competitive in this shifting landscape. These dynamics are closely tied to United States Reinsurance Market Demand, as regulatory stability influences both insurer participation and customer confidence.

Technology, Consolidation, and Future Outlook

Technology continues to shape the future of the industry. Tools such as artificial intelligence and machine learning are being deployed to improve underwriting accuracy, streamline operations, and enhance predictive capabilities. Meanwhile, consolidation remains a defining trend, with larger reinsurers acquiring smaller players to expand their market presence and better serve clients.

ESG commitments are also shaping strategies, as stakeholders demand sustainable and transparent practices. Taken together, these changes signal a dynamic path forward. Looking ahead, the United States Reinsurance Market Forecast points to continued innovation, stronger partnerships, and more resilient approaches to managing both traditional and emerging risks.

Ask Analyst & Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=20397&flag=C

United States Reinsurance Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Breakup by Type:

-

Facultative Reinsurance

-

Treaty Reinsurance

-

Proportional Reinsurance

-

Non-proportional Reinsurance

Breakup by Mode:

-

Online

-

Offline

Breakup by Distribution Channel:

-

Direct Writing

-

Broker

Breakup by Application:

-

Property and Casualty Reinsurance

-

Life and Health Reinsurance

-

Disease Insurance

-

Medical Insurance

Breakup by Region:

-

Northeast

-

Midwest

-

South

-

West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91-120-433-0800

United States: +1 201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0