Automotive Lubricants: Essential Components in Vehicle Performance

Lubricants Market By Type (Mineral, Semi-Synthetic, and Synthetic), By Product (Automotive Oils, Industrial Oils, Metalworking Fluids, and Other Products), By End-Use Industry, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

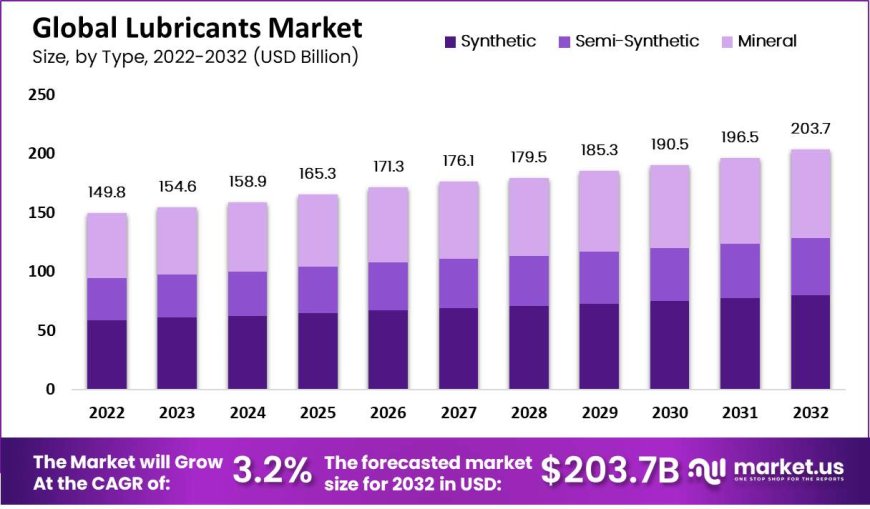

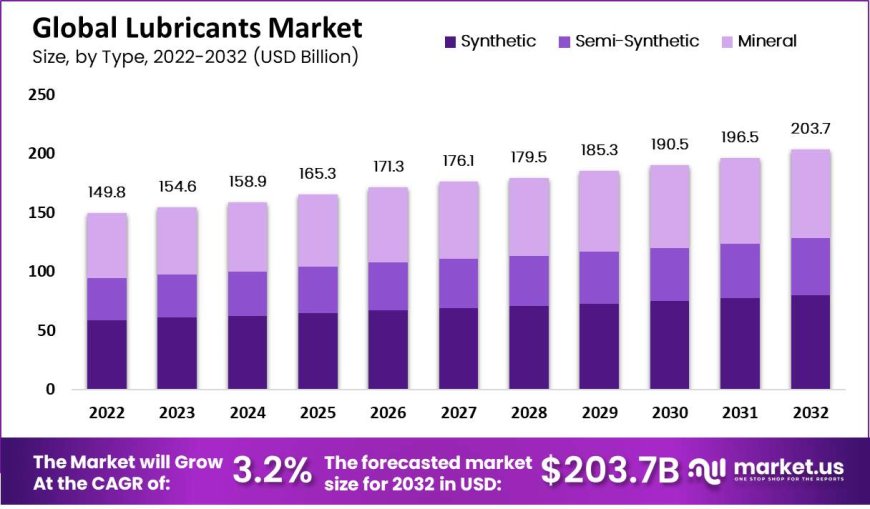

Lubricants Market size accounted for USD 149.8 billion. This market is estimated to reach USD 203.7 billion in 2032 a CAGR of 3.2% between 2023 and 2032. A variety of lubricants used in automotive, industrial, marine, and other applications are included in the sizable and expanding worldwide lubricant market.

The lubricants market refers to the global industry focused on the production, distribution, and use of various lubricants designed to minimize friction, wear, and heat between moving surfaces. Lubricants are crucial in numerous applications, including automotive, industrial, and marine sectors, as they enhance the performance and longevity of machinery and engines. In 2022, the market size was valued at USD 149.8 billion, and it is projected to grow at a compound annual growth rate (CAGR) of 3.2% to reach USD 203.7 billion by 2032.

The demand for lubricants is bolstered by the need for more efficient and durable vehicles and industrial equipment, especially as environmental regulations and energy efficiency standards become more stringent.

The lubricants market, segmented by type into synthetic, semi-synthetic, and mineral lubricants, sees synthetic lubricants as the dominant category, renowned for high performance under extreme conditions due to their chemical composition. Automotive lubricants lead in product categories, catering extensively to the transportation sector's diverse needs across engines, gearboxes, and transmissions.

Get a Sample Copy with Graphs & List of Figures @ https://market.us/report/lubricants-market/request-sample/

Key Market Segments

Based on Type

-

Mineral

-

Semi-Synthetic

-

Synthetic

Based on Product

-

Automotive Oils

-

Industrial Oils

-

Metalworking Fluids

-

Hydraulic Oils

-

Process Oils

-

Marine Oils

-

Greases

-

Other Products

Based on End-Use Industry

-

Transportation

-

Industries

-

Marine

Market Key Players

-

ExxonMobil Corp.

-

Royal Dutch Shell Co.

-

BP PLC.

-

Total Energies

-

Chevron Corp.

-

Fuchs

-

Castrol India Ltd.

-

Amsoil Inc.

-

JX Nippon Oil & Gas Exploration Corp.

-

Philips 66 Company

-

Valvoline LLC

-

PetroChina Company Ltd.

-

China Petrochemical Corp.

-

Idemitsu Kosan Co. Ltd.

-

Lukoil

-

Petrobras

-

Petronas Lubricant International

-

Quaker Chemical Corp.

-

PetroFer Chemie

-

Buhmwoo Chemical Co. Ltd.

-

Zeller Gmelin Gmbh & Co. KG

-

Blaser Swisslube Inc.

-

Other Key Players

Drivers:

The lubricants market is driven by increasing demand for automobiles and industrial machinery that require high-performance lubricants to enhance efficiency, reduce friction, and extend equipment lifespan. The automotive sector, in particular, is a significant driver as vehicles need various lubricants for engines, transmissions, and other components. The industrial sector also contributes to market growth as lubricants are essential for maintaining machinery performance and durability.

Restraints:

Growth in the global lubricants industry is limited by stringent environmental regulations aimed at reducing emissions and promoting sustainability. These regulations necessitate the development of eco-friendly lubricants, posing challenges for manufacturers. Additionally, the rise of electric vehicles, which require fewer lubricants compared to traditional internal combustion engine vehicles, is expected to decrease overall lubricant demand.

Opportunities:

The demand for energy-efficient lubricants presents a significant opportunity for the market. These lubricants can reduce friction and energy consumption, leading to cost savings and environmental benefits. The development of high-performance lubricants that can withstand extreme conditions, such as high temperatures and pressures, also opens new avenues for market growth, especially as Industry 4.0 technologies become more prevalent.

Challenges:

The main challenges include adhering to stricter environmental regulations and transitioning to eco-friendly products without compromising performance. Additionally, the increasing adoption of electric vehicles poses a challenge by potentially reducing the overall demand for lubricants. Manufacturers must innovate to create new products that meet regulatory standards and address the changing needs of the automotive industry.