France Kitchen Appliances Market Size, Share, Growth, Trends and Forecast 2025-2033

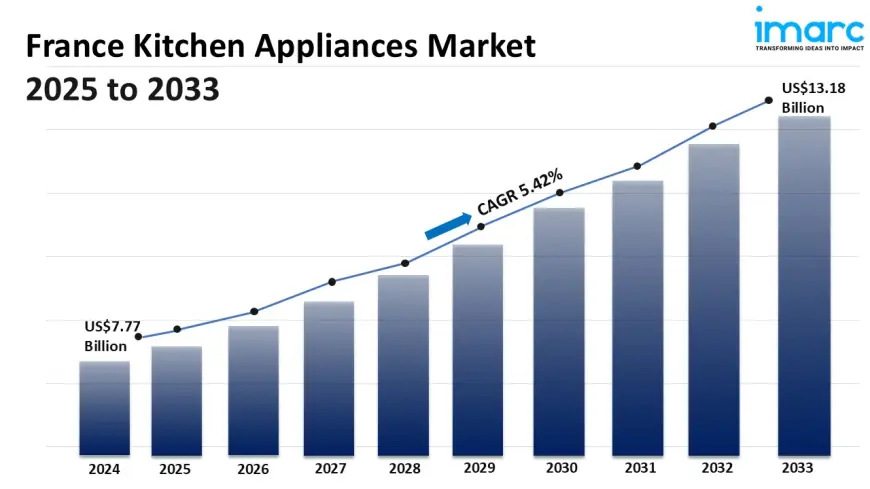

The France kitchen appliances market size reached USD 7.77 Billion in 2024. Looking forward, the market is expected to reach USD 13.18 Billion by 2033, exhibiting a growth rate (CAGR) of 5.42% during 2025-2033.

France Kitchen Appliances Market Overview

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 7.77 Billion

Market Forecast in 2033: USD 13.18 Billion

Market Growth Rate (2025-33): 5.42%

The France kitchen appliances market size reached USD 7.77 Billion in 2024. Looking forward, the market is expected to reach USD 13.18 Billion by 2033, exhibiting a growth rate (CAGR) of 5.42% during 2025-2033. The market is shaped by a rising preference for energy-efficient, connected devices and a strong focus on sustainability. Modern consumers seek appliances that offer both performance and elegant design. Growing interest in home cooking, supported by digital retail expansion and innovation in product features, continues to drive industry momentum, contributing to the growth of France kitchen appliances market share.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/france-kitchen-appliances-market/requestsample

France Kitchen Appliances Market Trends and Drivers:

A profound transformation is underway within French households, driven by the seamless integration of smart technology into the heart of the home: the kitchen. The market is experiencing a significant shift from standalone appliances to interconnected culinary ecosystems, where refrigerators, ovens, hobs, and coffee machines communicate to create an unprecedented level of convenience and efficiency. This evolution is fueled by a consumer base that is increasingly tech-savvy and time-poor, seeking solutions that streamline meal preparation and reduce cognitive load. Modern French consumers demand appliances that can be monitored and controlled remotely via smartphone applications, receive automatic software updates for improved performance, and leverage artificial intelligence to suggest recipes based on the ingredients available within a smart fridge's inventory. The demand for steam-assisted ovens and induction hobs with precise temperature control is seeing double-digit growth, as they promise restaurant-quality results with minimal user intervention. This trend is not merely about gadgetry; it represents a fundamental redefinition of the cooking experience, prioritizing personalized nutrition, reduced food waste through intelligent inventory management, and energy savings via optimized performance cycles, positioning the modern kitchen as a central hub of a connected, efficient, and intelligent home.

Environmental consciousness has decisively moved from a niche concern to a primary driver of purchasing decisions in the French kitchen appliances market. French consumers are demonstrating a robust preference for brands that authentically commit to circular economy principles, energy efficiency, and durable, repairable design. This is reflected in the surging demand for products boasting the highest European energy efficiency ratings, with A-class labels becoming a baseline expectation rather than a premium differentiator. Beyond mere energy consumption, the entire product lifecycle is under scrutiny. There is growing traction for appliances manufactured with recycled materials, such as bio-based plastics and recycled stainless steel, and for companies offering robust take-back and recycling programs for end-of-life products. The highly influential "repairability index," a French legislative requirement that scores products on how easily they can be repaired, is now a critical factor influencing market share. Manufacturers are responding by designing for longevity, ensuring the availability of spare parts for a minimum of ten years, and creating modular systems that can be upgraded rather than entirely replaced. This dynamic underscores a mature market where quality, ethical production, and environmental stewardship are inextricably linked to product value and brand loyalty.

The French kitchen is undergoing a renaissance as a central living space for entertainment, relaxation, and family life, catalyzing a powerful trend towards premiumization and sophisticated design. Consumers are investing significantly in high-end appliances that serve as both performance powerhouses and statement pieces, reflecting personal taste and elevating the overall aesthetic of the home. This is particularly evident in the robust growth of integrated and built-in appliance segments, where seamless cabinetry blending is paramount, and the rising popularity of statement materials like brushed brass, matte black, and professional-grade stainless steel in freestanding models. The demand for specialized, professional-style equipment, such as French-door refrigerators with advanced temperature zones, wine conservation cabinets, and powerful built-in bean-to-cup coffee systems, is accelerating as home cooking becomes a more serious and celebrated hobby. This shift is less about basic functionality and more about achieving a "chef's kitchen" experience at home, driven by a cultural appreciation for gastronomy and a desire for domestic luxury. Manufacturers are focusing on tactile finishes, intuitive user interfaces with minimalist displays, and acoustically optimized appliances that maintain a quiet kitchen environment, catering to a consumer who views their kitchen as the ultimate expression of lifestyle and refined taste.

France Kitchen Appliances Market Industry Segmentation:

Product Type Insights:

- Refrigerators

- Microwave Ovens

- Induction Stoves

- Dishwashers

- Water Purifiers

- Others

Structure Insights:

- Built-In

- Free Stand

Fuel Type Insights:

- Cooking Gas

- Electricity

- Others

Application Insights:

- Residential

- Commercial

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Departmental Stores

- Others

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=38597&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0